Introduction

How does health insurance work in Switzerland? Why is it compulsory? Why does the cost increase every year? Do I need to take out supplementary insurance?

These are all legitimate questions that we often struggle to answer. In this article I will try to give as many answers as possible to all these questions and more. The goal is to make you, dear reader, aware of how this system works and to have the right tools to reduce the costs associated with it.

How it works

Health care insurance in Switzerland works with the classic cost-sharing system. Basically, every citizen in Switzerland has to pay a certain amount of money each month to the health insurance fund. This sum not only goes to cover possible costs derived from a citizen’s future illness but also cover the costs of other citizens. This significantly lowers the cost to the individual citizen in case of actual need, because without cost sharing among citizens, the individual sick person would have to pay (if he/she is unlucky) even tens of thousands of francs for treatments. The model, at least at the theoretical level, is ideal.

Of course, not every citizen has the same advantage through this system. Normally as people get older, their health problems also increase and thus the costs associated with care. So, as we see in the example below, this cost-sharing system gives a disadvantage to healthy young people and gives an advantage (saving money) to elderly people. I do not want to discuss ethics in this article but this is how it works.

Cost pooling example

Let us pretend that there are five groups of people, with different ages, and that as age increases, the risk (shown as a % probability) of getting sick, increases. Let us then say that the risk is to face a medical intervention costing 10’000CHF. The money set aside by each group to cope with this remote case of expense is shown in the “willingness to pay” row. The fair premium, that is, the cost of the surgery multiplied with the risk, is what is also called the expected cost, which reflects the most fair possible health insurance premium for that age group. Now, in the Swiss system, costs are shared among all different age groups: doing a short calculation, the average risk among all the groups below is 50% (20% +40% +60% + 80%)/5, so the shared premium in case of surgery is 50% *10,000CHF = 5,000CHF. This premium therefore puts the least risky group (18-35) at a disadvantage while it puts the others at an advantage.

| Age | 18-35 | 36-45 | 46-59 | 60+ |

| Risk | 20% | 40% | 60% | 80% |

| Willingness to pay | 2’500 | 5’200 | 6’800 | 8’500 |

| Fair premium | 10’000*20%= 2’000 | 10’000*40%= 4’000 | 10’000*60%= 6’000 | 10’000*80%= 8’000 |

| Pooled premium | 5’000 | 5’000 | 5’000 | 5’000 |

| Surplus | -2’500 | +200 | +1’800 | +3’500 |

Of course, this example has limitations: in Switzerland, the premium paid increases as age increases (until 26 years of age), but despite this, older age groups are still at an advantage over younger age groups.

Age categories and geographical division

Health insurance in Switzerland, as mentioned earlier, divides the population into three age groups: children (0-18), young adults (19-25) and adults (26+). Children pay the lowest premium, while adults pay the highest premium; it is important to note that there is no increase in premium as age increases after age 26, so a 30-year-old may pay the same as an 80-year-old (excluding other factors that may vary the cost).

Health insurance is also not entirely shared at the national level, but rather at the cantonal level. In fact, in some cantons (normally wealthier ones such as Zug or Zurich) the health insurance premium is lower, for all age groups, than in poorer cantons (Ticino, Neuchatel) or with higher elderly populations. This is another unfavorable factor in the Swiss system, which can create oases of low costs and at the same time hotspots of high costs.

The citizen can then move, at least theoretically, within the territory of Switzerland and place their tax residence in a canton where premiums are lower.

Compulsory Health Insurance: the basis cover

Health insurance in Switzerland is divided into two: basic cover which is compulsory and supplementary cover which is voluntary. The basic health insurance is the mandatory one and is responsible for most of the health-related cost sharing. The law describes what the basic health insurance fund must offer its patients. What is special about the Swiss system is that the basic health insurance is compulsory by law, but there is no national public health insurance but rather many different private health insurance companies, from which the citizen can choose. This can pose advantages and disadvantages: the advantage, at least in theory, is that of competition, where some health insurers could prevail over others by leveraging lower prices. A disadvantage is that of not complete transparency, since they are private institutions anyway, there is no obligation for complete transparency regarding how and where the premium money collected from insured citizens is used: many times it is used for marketing purposes.

The deductible

Basic health insurance gives the insured the option of deciding which deductible to adopt. The deductible is a sum of money that the insured will have to pay on his or her own, in case of need for treatment (surgery, doctor’s visits, medication, ec) before the insurance intervenes by paying for the insured. The Swiss model proposes the following deductibles for children: 0, 100, 200, 300, 400, 500, 600CHF, while for adults they are: 300, 500, 1000, 1500, 2000, 2500CHF.

After reaching the deductible limit by paying for the care for themselves, the adult insured will have the help of the health insurance company that will intervene by paying for the care, however by law the insured will still have to pay 10% of all health care costs up to an annual limit of CHF 700, while for children it is 350CHF. After reaching even that limit, all costs will be fully paid by the health insurance company, for that year. It is important to remember that both the deductible and the maximum cost-sharing of 700CHF, restarts from zero at the beginning of each new year.

What deductible to choose?

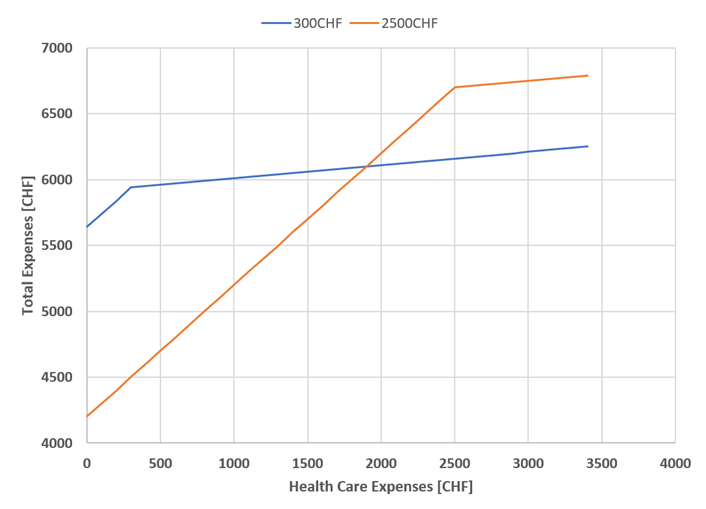

Only two deductibles among the many proposed really make sense: the minimum (300CHF) and the maximum (2500CHF), this for pure statistical reasons: if one expects to have to pay less than 1900CHF of health-related costs, then the high deductible is the one that makes the most sense, moreover the insured in this case should have a small emergency fund with at least 3200CHF (2500CHF deductible + 700CHF for additional cost sharing). On the other hand, if you plan to spend well over 1900CHF, then the correct insurance is the one with the deductible at 300CHF, but in this case the insurer should expect high monthly premiums.

Where does this spending limit of 1900CHF come from? Very simple: let’s assume a monthly premium of 355CHF for the 2500CHF deductible and 470CHF for the 300CHF deductible. We can create a graph, where in the horizontal axis the cost of medical care is located and in the vertical axis what the patient will actually pay (health insurance premiums plus cost-sharing and deductible). The meeting point of the two lines is at 1900CHF of health care expenses, which means that if during the year you expect to have less than 1900CHF of expected medical expenses, then the best model is the one with a high deductible. If in the contrary case you expect to spend more than 1900CHF, then the low deductible makes more sense.

How to compare premiums

The easiest, most transparent and official way there is to compare the premiums of different health insurance companies is through the Swiss Confederation’s comparator:

Official Base Insurance Comparator

Here, in addition to being able to enter one’s data, one can also decide what deductible to use to compare the prices of various health insurance companies and decide which health insurance model to adopt.

There are several possible models: the family doctor model, where the patient first goes to his or her doctor in case of need and then the doctor decides where to refer the patient. The free choice model: where the patient freely decides which doctor to go to, without going through the family doctor. Alternative models: such as the medical center model, or doctors affiliated with an organization to reduce costs, here there is no family doctor but the patient goes to the network of doctors who decide how to distribute patients. Also increasingly taking hold is the telmed model: that is, in this mode the patient must first call a toll-free line, explaining his or her ailment, and then the operator will refer him or her to a doctor or not.

The most cost-effective models vary from canton to canton; in principle, the free doctor’s choice model is the most expensive, while the telmed model is the least expensive. The family doctor model is also not too expensive, plus it is increasingly supplemented by health insurance companies with the telmed model to reduce costs even more. To see which model is the cheapest, just select all the models in the comparator.

How to cancel compulsory health insurance

By law, compulsory health insurance can be canceled annually, by Nov. 30, by letter. There are a variety of pre-packaged cancellation forms; you can find one here:

Pre-packaged cancellation form

Does it make sense to change health insurance companies often?

Absolutely. Every year, as soon as the new premiums are available for the following year (usually at the end of September), people should take an hour to avoid throwing away hundreds of francs the following year. What you should do is to use the comparator I mentioned earlier and see which insurance companies offers the lowest price for your needs (same model and deductible as before). If you find something cheaper, you should not hesitate to switch, because it is only a benefit for you.

Supplementary Health Insurance

In addition to basic coverage, which is mandatory by law, there is also supplementary or supplementary coverage, which is entirely optional. This type of health insurance is not regulated as strongly as the basic one; it is also a private contract between the insured and the health insurance company. The conditions and what is covered by supplementary insurance can vary greatly from one contract to another, as can the price.

Does it make sense?

It depends. If the citizen knows that he or she will not have any special medical expenses in front of him or her, does not travel abroad often, and does not suffer from any other special distress, then probably not. In other cases it may be attractive if it covers benefits not covered by basic insurance such as eyeglasses, psychotherapy, gym membership contribution, acupuncture, ec.

The patient should first figure out what he/she needs for that year and then search through an online comparator, which supplementary insurances exist for his/her needs and then choose the most convenient one.

The most widely used comparator for supplementary insurance is as follows:

Supplementary Insurance Comparator

What to watch out for

As mentioned above, supplementary insurance is a private contract between the insured and the health insurance company, and is therefore far more exposed to hidden costs than basic health insurance. It is important to pay attention to the following points before signing the supplementary health insurance contract:

- What is covered and up to what amount, what is the insured’s participation after the maximum threshold.

- What is not covered.

- Often health insurance companies put the contract term at three years by default without warning, be careful and ask for the one-year contract. Don’t be distracted by possible derisory discounts.

Other important points

Since it is a non-mandatory insurance, the health insurance company when you apply for supplementary insurance has the right to ask you questions about your health status and even has the right to deny you the possibility of having a supplementary insurance if it believes that your health is very poor or that you are an at-risk person. This is not ethically correct, but it is allowed by law.

It is also important to remember, that you can always keep your supplementary insurance with one health insurance company and your basic compulsory insurance with another health insurance company. In such a case, basic coverage will be taken over by the basic insurance and extra benefits (such as single room during hospitalization) will be supplemented, if applicable, by the supplementary insurance.

The future of health insurance in Switzerland

The future is uncertain but it is certainly costly. Every year for decades now there has been a steady increase in health insurance (except after the pandemic with a derisory 0.2 percent in 2022), for example in 2024 the average increase was 8.7 percent over 2023, well above inflation in Switzerland over the same period (2.2 percent). There are many reasons for this: the reserves of private health insurers that are beyond the legal requirements, the ever-increasing costs of health care services, an outdated fee schedule, and the usual false myths, such as that people go too often to the doctor when not necessary.

Personally, I think a complete structural reform is needed: a new fee schedule, the elimination of private health insurers for mandatory basic coverage, and the creation of a single nationwide health insurer for basic benefits. It makes no sense that a basic insurance should campaign to grab as many customers as possible if its main purpose should be not to make profits but to serve the population by insuring risk over as large a pool as possible to reduce costs. Unfortunately, there is a strong lobby that influences politicians at the federal level (as well as some federal councilors), so I see very little likelihood that this change will happen soon.

Conclusion

We have seen what health insurance is in Switzerland, how it works and how to avoid spending more money than you need to. In addition, I have given you some useful tools to help you decide based on your situation which is the best choice for your health insurance. Now it’s up to you to take the right path. I hope you enjoyed the article and see you in the next one. Bye!