Introduction

In this short article I will explain how the Swiss pension system works in the most simplest terms. We will see what the famous three pillars are and why it is important to know about it. Let’s get started!

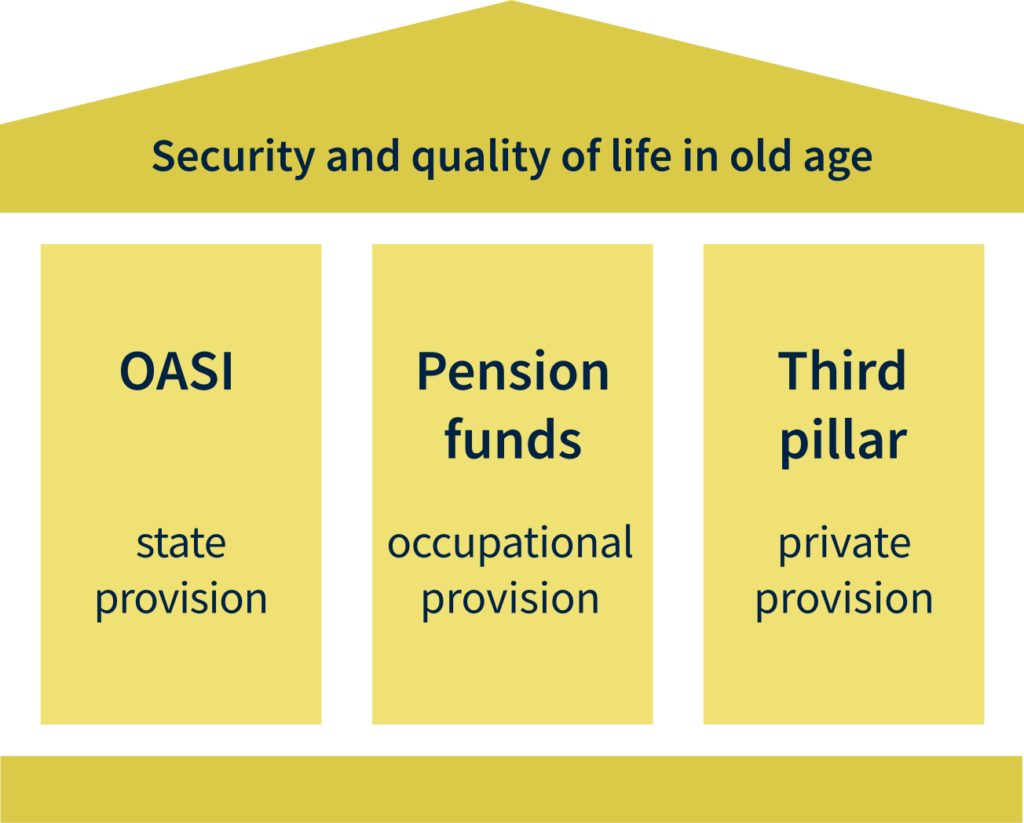

1. The Swiss model

The Swiss model of old-age provision consists of three pillars, which are: state provision, also called OASI (1st pillar), occupational provision linked to a pension fund (2nd pillar) and private provision (3rd pillar). In the figure below, they are visible from left to right.

1.1. The first pillar

The first pillar is the responsibility of the government and is based on the principle of solidarity, which means that people from the age of 20 (or 17 if they are already working) must compulsorily make contributions, even if they do not have a job. This money paid today goes to today’s retirees and not to the taxpayer in the future. This first pillar is also called OASI which stands for Old Age and Survivors Insurance. Although the money paid in does not go directly to the taxpayer in the future, it is important to make contributions every year, otherwise about 2.3% will be subtracted from the future OASI pension for each year of unpaid contributions.

The contribution rates for employees for the first pillar are as follows:

OASI (Old Age and Survivors Insurance) 8.7 %, DI (Disability Insurance) 1.4 %, IC (Compensation Insurance) 0.5 %, for a total of 10.6 percent, half of this (5.3 %) is taken by the employer while the other half by the taxpayer. Unemployment insurance (2.2%) is then also deducted from the paycheck and borne by the taxpayer.

The main goal of this pillar is to ensure a minimum annuity that is essential to live on when you reach retirement age. Unfortunately, with the aging population and decreasing working-age population, I don’t think this system will still have a long life in the future, but it is important to know its mechanism today.

More info about the first pillar

1.2. The second pillar

The second pillar is related to work. This pillar is mandatory for most working people. Contributions made go to a so-called pension fund that manages and invests them following federal and cantonal guidelines while also having its own room for maneuver. The (theoretical) goal of the first and second pillars combined is to guarantee at retirement age an income equal to 60 percent of your last salary before retiring. You are obliged to be affiliated with a second pillar if you meet all of the following conditions: be at least 17 years old, be insured under the first pillar (i.e., pay OASI contributions), and be an employee with a minimum salary of 22,050CHF per year. However, a worker can decide to join on a voluntary basis even if he or she does not meet all the criteria above or if he or she is in one of these situations: he or she is self-employed, earns less than 22’050CHF, or has a short-term contract (maximum 3 months).

Second pillar contributions are paid in equal shares between the employee and the employer; in some cases the employer may even dedicate to assume more than half of the costs. Contributions are automatically deducted from the monthly paycheck and are deposited in the pension fund with which the company you work for is affiliated. If the worker is independent, he or she can decide for himself or herself which pension fund to apply to. The percentage of the mandatory salary to be paid into the pension fund depends on the worker’s age and generally increases with age. The contributor can also decide to pay more than the mandatory minimum into his second pillar, with so-called voluntary payments.

In case your salary falls below the minimum threshold (20’050CHF) or you are unemployed or if you leave for foreign countries and if you decide to stop working or take a sabbatical, ec. You are no longer obliged to make contributions to the second pillar. However, the accumulated money cannot be spent; it is tied up and must be transferred from your last employer’s pension fund to a bank or financial institution of your choice to an account called a “vested account.” This is a kind of parking lot where you can temporarily pause your money. Once you resume employment as an employee (or otherwise meet the conditions for mandatory contributions) you are obliged (unfortunately) by law to transfer the money from the vested account to your new employer’s pension fund. If you did not open a vested account when you stopped working, your money is automatically transferred after a certain period of time into a national pension fund called the “Collector’s Institute Foundation,” which will then automatically proceed to transfer your money to your next employer’s pension fund.

The second pillar can normally be withdrawn upon reaching retirement age, which in Switzerland is 65 for both men and women; some pension funds even allow withdrawal earlier at age 58. However, there are other cases in which capital can be withdrawn or used as collateral before retirement:

- Purchase of primary residence (mortgage amortization or as collateral).

- Starting a business as a self-employed person.

- If you leave Switzerland permanently: however, you cannot withdraw your capital in advance if you intend to settle in an EU/EFTA state, because you are already compulsorily insured for retirement benefits in these states. In this case, a portion of your retirement savings (the “mandatory portion”) remains tied up in an account in Switzerland until retirement age, while the “super-mandatory” portion can be withdrawn immediately.

More info about the second pillar

1.3. The third pillar

The third and final pillar is designed to secure additional money for retirement, although nowadays I very strongly recommend opening this private and voluntary pillar, because with an aging population it is unrealistic to rely only on the first two pillars.

The third pillar is divided into restricted (3a) and unrestricted or unconstrained (3b) pension provision, let us now see what changes.

The restricted third pillar (3a):

A sum of money can be paid into a bank or financial institution (such as a fintech company) or insurance (not recommended) each year. The main features are as follows:

- Voluntary contributions made to this account can be deducted from your taxable income, so you will pay less tax at the end of the year. The maximum amount that can be deducted and thus the amount to be paid annually into Pillar A changes every two years and increases in step with inflation. In 2024 this amount is CHF 7,056 for employees and CHF 35,280 for the self-employed.

- The accumulated assets cannot be withdrawn before retirement except under special conditions (see below).

- The interest rate is higher than that of a savings account, so it is better to invest in such an instrument than to leave capital in a bank account.

- A fee must be paid when the capital is withdrawn.

Pillar 3 can be subscribed to and deposits made by virtually anyone with the will to do so and the financial means. Even those who work in Switzerland but live abroad can open such an account, as can those who continue to work after retirement age or if you are unemployed.

The conditions for early withdrawal of capital from Pillar 3A are as follows:

- If you want to buy a house

- Leave Switzerland for good

- Open a business as a self-employed person

- Receive a full disability pension (DI) and the risk of disability is not insured

Early withdrawal of capital from Pillar 3a is also possible without the conditions above: you are allowed to withdraw up to five years before retirement age from Pillar 3a.

The unrestricted third pillar (3b):

In this part of the third pillar, the taxpayer can voluntarily make unlimited annual contributions, no money can be deducted from taxable income, and therefore there is no tax benefit. The capital can be withdrawn at any time, depending on contracts with insurance companies or financial institutions there can be exit and/or entry fees. I personally would not recommend this type of instrument, it is much more efficient and convenient to have an investment plan with a broker than a third pillar 3b account.

More information about the third pillar

Conclusion

Now you know how the Swiss pension system works, there are of course many small details that may need further analysis, depending on your personal working situation. Feel free to read the recommended links about the three pillars cited in the article for more information.

I am sure that you will not be scared anymore talking about pension plans with your pals, coworkers or family. See you in the next article!