Introduction

Making a budget for one’s personal expenses and especially quantifying how much to spend at most in each spending category (food, entertainment, ec) is not always easy or painless. However, this is essential for most people, as is having a track of one’s expenses and income. Without this track and a budget, one has no awareness of where one’s money is being spent and how to reduce certain unnecessary expenses. In this article, I will discuss budgeting guidelines, how I keep track of my expenses and income with various tools, and how you can do it too. Let’s get started!

1. Budgeting Guidelines.

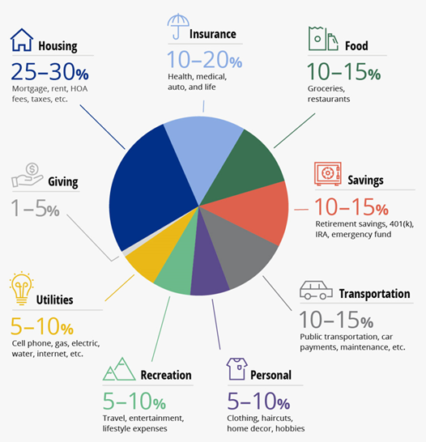

First of all, it is essential to describe how monthly/annual spending should be distributed for most people:

Source: https://www.fultonbank.com/Education-Center/Saving-and-Budgeting/Budget-Categories

One of my favorite and I think most reasonable budgets I have ever seen is the one proposed by Fulton Bank (I don’t get paid to say that). Of course, each person is different and may have special needs that move the percentages to one side or the other. In any case, this chart can serve as a guideline and after you have taken all the steps described in this article, try to compare yourself with these percentages and see if you can correct something or you are already virtuous now.

2. Tracking Expenses and Income

An important step for anyone at any age and wealth is that of expense analysis: how much I am spending and on what. Again, we are not talking quantum physics here but simple addition and subtraction. What is usually missing, however, to make a calculation that gives reliable results is a written list of expenses, that is, how much you are spending and on what exactly. I strongly believe that the first step in putting a cap on spending is to collect data on monthly personal spending. This can be done in many different ways: with an app (there are thousands of them for free) where you can record, physically writing down how much you spend and categorizing your spending as soon as you have made that purchase or paid out that amount of money, or by writing it all down on a sheet of paper, or even by writing it all down on a spreadsheet like Excel. I’m not a big fan of the monthly checking account balance that banks come up with, this is because your checking account doesn’t accurately reflect your spending and because by not filling out that balance yourself, you’re distancing yourself and not fully understanding its importance. If, on the other hand, you yourself note on your app, day by day, all your spending and at the end of the month you look and see at a glance how much and what you spent on, seeing your notes and your spending categories, it will seem much closer and in your control.

One application that I would recommend (among the thousands out there) is Money Manager Expense & Budget (I do not get paid to advertise it). With this free app, which I have been using for years, the user can create personal expense categories, personal income categories, set a budget for expenses, and it all works offline. The app is available for both Android and iPhone.

Download here: iPhone or Android

3. Spending Analysis

The second step after figuring out how much you spend is to analyze in what you are spending too much and in what you are spending the right amount, where in short there is room for savings and where there is none. You can for example cut back in meals out, in clothing, change cars to a less expensive one, ec. But how do I know if I am spending the right amount? Ask yourself if it is critical to your happiness, not if it makes you happy. For example, if I am spending a lot of money each month on streaming subscriptions, console games, ec. I have to ask myself whether this is actually fundamental or whether maybe I need to change my behavior and decide to cut all that out. This second step in short, is the most delicate one and is the one where only people who are really willing to change are bound to excel, while everyone else, past the moment of temporary financial crisis, will go back to their old spending habits, whereas the change I mentioned should be something lasting.

Spending analysis, in practice, is done as follows: after keeping track of all monthly expenses and income, these values should be reported on any spreadsheet such as Google sheet, Excel, Open Office, Numbers, ec. Don’t worry, this little job only needs to be done once a month and it takes maybe 10 minutes but it will help you so much in figuring out how you are doing financially. So, at the end of the month, open the app and look at the total for each expense category, then report this total in the same expense category for that month in your spreadsheet, super simple. Repeat this step for each category of expense or income and you’re done. There are lots of examples of spreadsheets for tracking your expenses, the important thing as also with the expense categories we use in the app mentioned earlier, is customization. This means that not all people have the same expense items, someone might have a cat and therefore have the “cat” item under expenses while others do not. This also needs to be reflected in the spreadsheet.

Below you will find my Excel spreadsheet to track expenses, income and savings. Feel free to download and tailor it to your needs:

4. Correction and Direction

The third step is the enactment of expenditure control. Enacting means consciously reducing spending by not buying or reducing the purchase of certain items. This is the big power that comes from the steps before: awareness. Also, after recording all expenses and entering for a year, we would have enough data in this spreadsheet to draw up an annual budget and see how much you saved and spent during the year. After, on the other hand, a few years from the beginning of this exercise, you will have a chance to compare between years and quantify the increase, stagnation or (hopefully not) decrease in your savings, which I remember, are your income minus your expenses.

I know, it’s not the most fun thing in the world, but I believe that anyone who does not have full control over their spending, and therefore their money, can never aspire to be wealthy or even rich.

5. Who Does NOT Need a Budget (but still control spending)

Yes, you read that right. After spending all this time talking about budgets, I now say there are those who don’t need one. Am I delusional? No, not yet. The world is beautiful precisely because it is varied, as someone used to say, and on this globe, there are also people who have a characteristic that is entirely superior to any budget one can create: frugality. The frugal people or those who do not need to assert themselves in front of others and who are content with little, yet not unhappy, are those who live with a tight perennial budget in their heads, who therefore judge every single expenditure by putting on the two plates of the scales essentiality and missed opportunity by buying this instead of that other. Simply put, these frugal people do not have to budget because they have a happy ant mentality. They will never need to be reminded to make a budget or to write down their expenses because they already do both, consciously or unconsciously. If you are not sure if you are such a person it is because you probably are not, so do what I explained earlier, but if reading these lines brings a smile to your face, you probably know who I am talking about.

Conclusion

In this short article you have learned the importance of tracking expenses and income, understood how to do it in practice, and how to analyze the data you collect. This is a great first step, so congratulations! But now we have to decide what to do with this saved money, more specifically, what not to buy, how to invest, and how to create a plan to stop working. I look forward to seeing you in future articles…Bye!